Investing in Birkins??

The case for making "alternative investments," and a look into what actually holds value

Substack has truly become my favorite space on the internet - a safe haven where I can openly share my learnings as a new founder. Our growing community inspires me every day, and I'm so excited for everything we are going to bring to life together this year.

The idea for this post came to me at about 10 PM while brushing my teeth one night, naturally fantasizing about stealing a Dior bag from my mom, which she has had since the 1980s. Where was it? I needed to ask her…but it also got me wondering about the appreciation of “alternative investments,” like bags that stand the test of time.

We tend to refer to possessions and splurges as investments, but what’s the true measure? Are they really investments? Research shows that, in fact, they can be - and going forward, shoppers can be ever savvier with the technology and tools available to them.

I hope you enjoy this deep dive into the new era of investing, c/o my mother’s vintage Dior (I need to go off and find it now). Thank you, as always, for being on this thought journey with me!

Now onto the good bits...designer bags and ROI. We are not talking about the impulse buys collecting dust at the back of your closet. We are talking ICONS - the ones that are passed down through generations, and serve quite literally as conveyances of personal savings. They might even MAKE you money.

I've been up to my ears in researching all available data, and the TLDR of one of my favorite studies -- disclaimer its insanely long -- goes into tracking the annual returns of 12 iconic bags from Hermès, Chanel, Louis Vuitton, and Dior, using sale records from the resale market and heritage auctions.

The results are airtight, and confirm what most of us ladies have always known: the true gem of “alternative investments” is the Birkin.

The "Designer Bag 12 Index," tracking 12 bag models, posted an annual return of 7.4% with a volatility of 6.88%, resulting in a Sharpe Ratio of 53.80%.

What, pray tell, is a Sharpe Ratio? This is a measure of risk-adjusted return, which compares an investment's excess return to its standard deviation of returns.

And 53.8% is REALLY good meaning the index generated a super high return compared to the amount of risk taken on for the investment type.

These results mean that the Designer Bag 12 Index outpaced stocks, bonds, and even fine wine during the study period from 2011 to 2017.

And the Birkin? Well, she had an annual return of 13.44%. This means the bag outperformed major market indexes between 2011 and 2017.

Let’s look at the runners up for even GREATER conviction when discussing finances at the dinner table. Chanel’s 2.55 and Lady Dior bags have also shown solid returns.

Think of it as a dance, driving desirability and therefore long-term returns stability: emotional value, scarcity, and market demand all playing together (and consider me, lusting after mom’s 80s Dior to this day!)

Key takeaway? If you're considering bags as an investment, stick to classics or products with limited production and historical significance.

Some more food for thought, if you’re thinking of a splurge, and whether it’s going to serve you well:

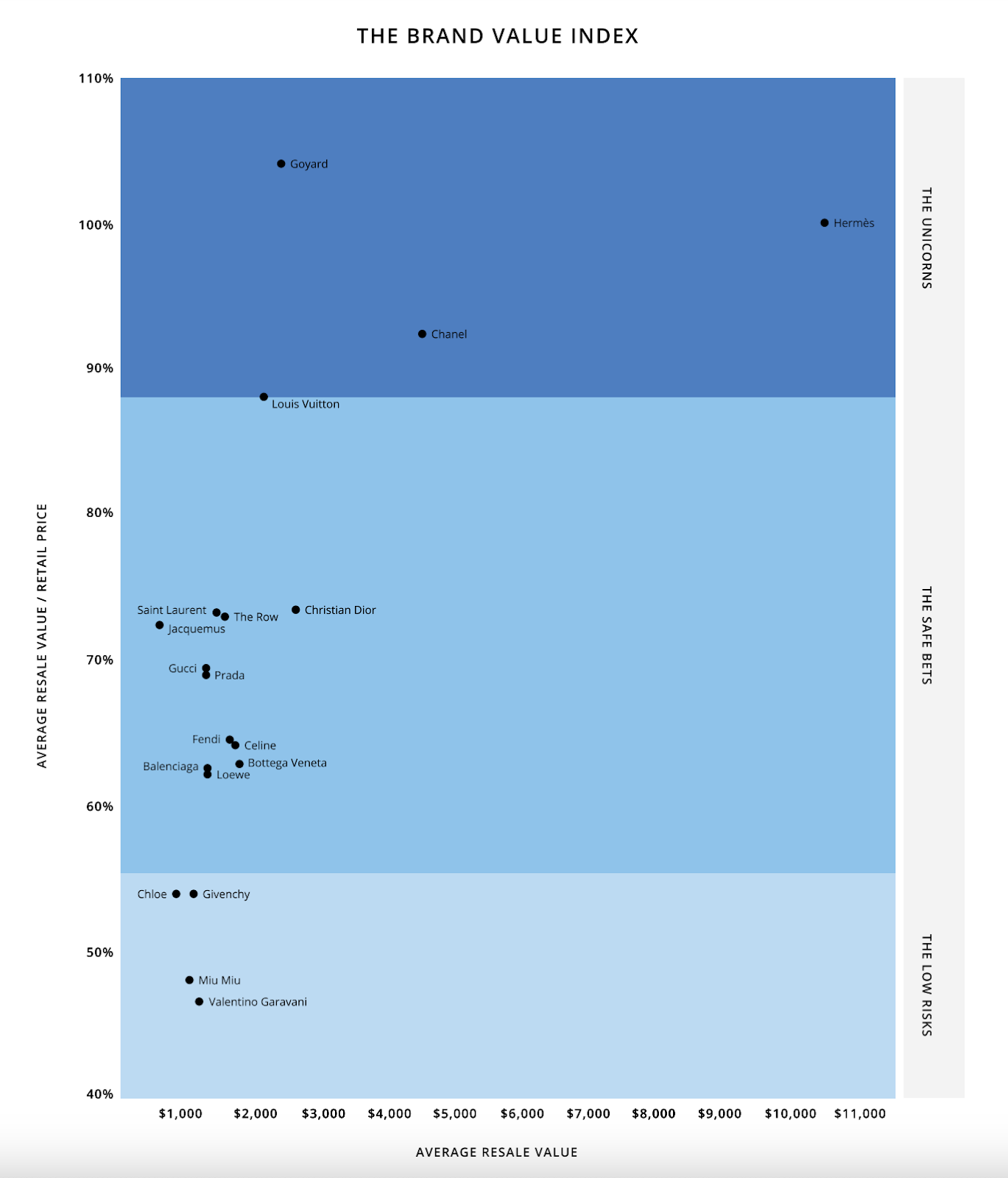

When we look at what bags from different designer brands hold their value both from our own internal data and from other market players like Rebag, we see that on average bags from Hermes, Chanel, Louis Vuitton, and Goyard hold the most value. But Dior, The Row, Saint Laurent, and Jacquemus aren't far behind. Recent data also suggests a dip in demand for higher-priced luxury bags, with prices for Chanel, Gucci, and Louis Vuitton decreasing by 20%, 17%, and 9% respectively on the Realreal this year. This trend means that Miu Miu and Bottega Veneta purses are seeing an uptick of demand on the resale market which means their retained values will be on the up and up come 2025... although its hard to imagine that even with these changes that they levle with the Chanels or Hermes of the world.

Of course, investing in bags comes with risks. Counterfeits, market saturation, and evolving tastes all play a role. Marketplace fees are also not factored into return analysis, and condition plays a huge role—my YSL bag I drag to the Phia offices every day, laptop in tow, isn't holding her value, BUT knowing that if she were still in her prime, she absolutely would does make me feel good.

I'm not the only one factoring resale value into my purchasing decisions. In fact, 57% of Gen Z and 50% of Millennials consider resale value when purchasing luxury goods regardless of whether they plan to resell or not.

It’s a new year, and as part of my set of commitments to myself, I will keep the data flowing for you, so you can become the smartest shopper in any room or corner of the internet.

You can continue to find us here on Substack with regular, real-time insights on what luxury items are TRULY worth your money, fashion job opportunities, breakdowns of consumer market trends with sexy stats, and an inside look at how we are evolving at Phia.

Alas, I need to get back to bug bashing now, but let us know below what content you want more of!

As a finance bro who looks at returns and sharpe ratios all day long, this was genuinely such an awesome and intriguing read

Fascinating